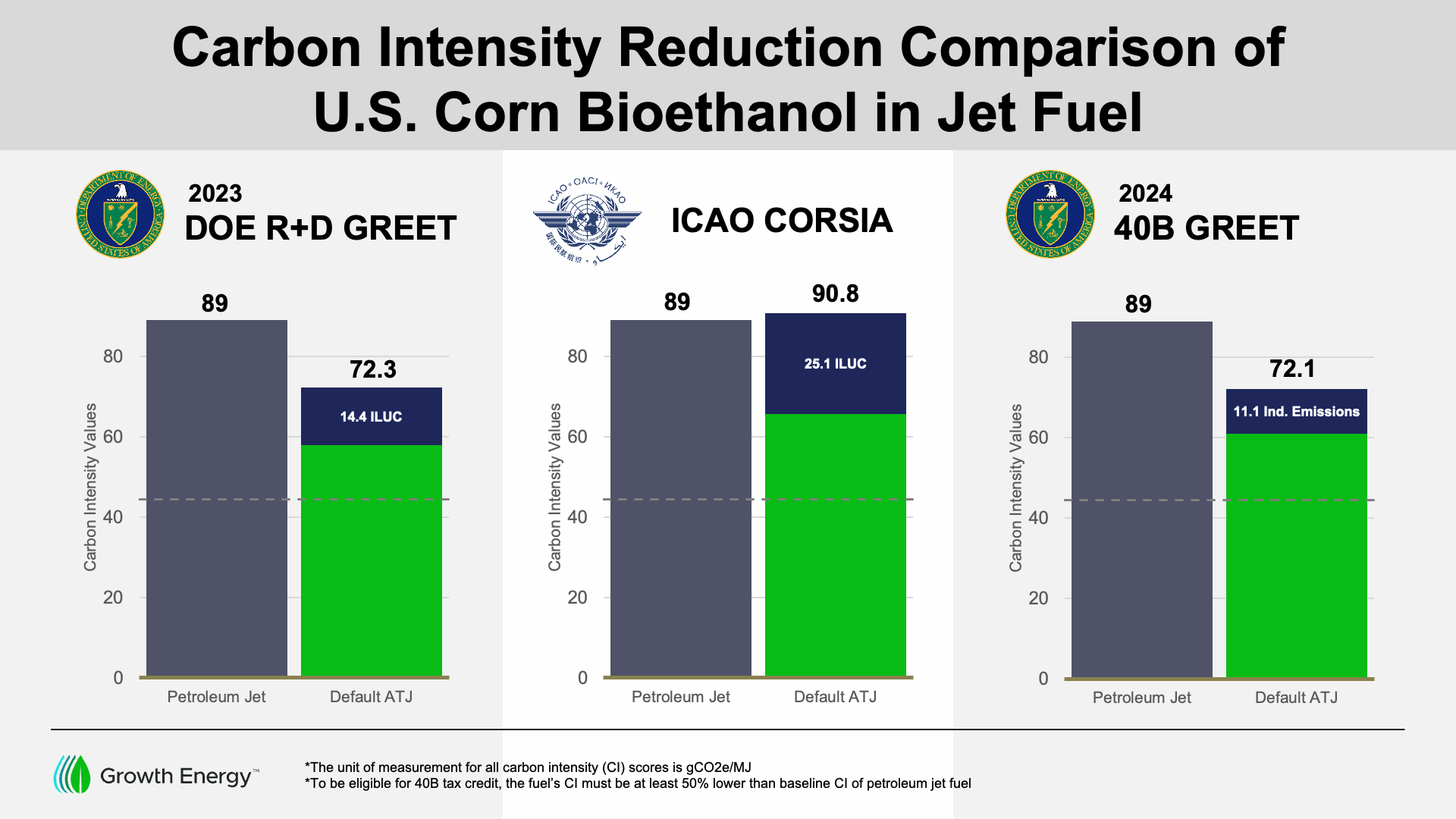

The GREET Model uses the most up-to-date science to accurately estimate the emissions reductions of bioethanol.

The U.S. Department of Energy Argonne National Lab’s Greenhouse Gases, Regulated Emissions, and Energy Use in Transportation (GREET) Model is the gold standard for measuring the emissions-reducing power of farm-based feedstocks and biofuels. It incorporates up-to-date science that more accurately scores lifecycle carbon intensity for corn ethanol and other renewable fuels.

If federal regulators use the GREET model to administer tax credits from the Inflation Reduction Act, it is more likely that national goals such as the Biden Administration’s SAF Grand Challenge for decarbonization of the airline fleet will be met. Additionally, farmers, rural communities, and U.S. biofuel producers will be able to participate in global SAF markets and seize opportunities in other hard to decarbonize sectors.