The Asks

- Congress must

- Oppose efforts to repeal tax credits like 45Z (clean fuel production credit), 45Q (carbon capture tax credit), and 40B (sustainable aviation fuel tax credit).

- Extend the pro-growth 45Z tax incentive for low-carbon biofuels.

- Officials throughout the federal government must ensure that tax incentive modeling accurately reflects the low-carbon benefits of bioethanol and uses the most up to date science through the use of the Department of Energy Argonne National Lab’s GREET model.

- The U.S. Department of the Treasury must finalize a 45Z tax credit rulemaking by the end of 2024; the rulemaking should include granular calculations for carbon reducing technologies at the biorefinery and on-farm climate-smart agriculture practices.

What Role Do Tax Incentives Play in Lowering Carbon Emissions?

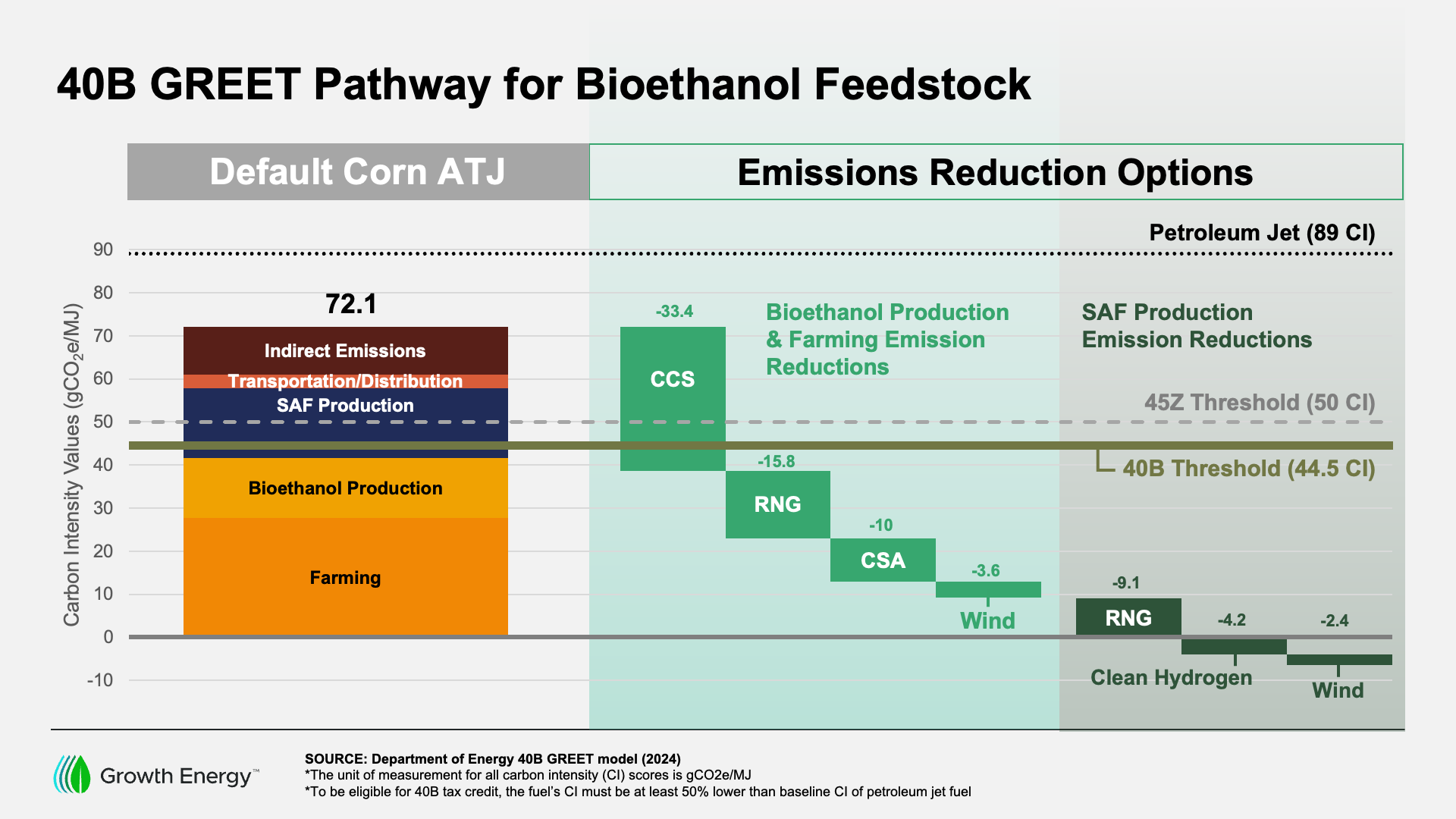

Biofuel producers and their products lower carbon emissions every day, but tax incentives play a role in spurring investments in technologies that further lower their carbon intensity (CI) scores. The biggest and most promising of these technologies is carbon capture, utilization, and storage (CCUS), in which biogenic CO2 emitted during the ethanol production process is either sequestered safely underground or captured and sold for food and beverage and healthcare applications. CCUS and other technologies like it can help biofuel producers lower their emissions, which lowers their CI scores, and in turn helps them qualify for bigger tax incentives.

These incentives don’t just lower emissions, but also provide the certainty that the U.S. biofuels industry needs in order to compete in global next-generation fuel markets, particularly when it comes to sustainable aviation fuel (SAF). In order to unleash innovation and job opportunities through rural America, while supporting the strength and longevity of Midwest communities and the liquid fuels sector, regulators must pursue a technology-neutral approach to these tax incentives, and administer them using the U.S. Department of Energy Argonne GREET model.

What Is the GREET Model?

The U.S. Department of Energy’s Argonne Greenhouse Gases, Regulated Emissions, and Energy Use in Transportation (GREET) model is the gold standard for measuring the emissions-reducing power of farm-based feedstocks and biofuels. It incorporates up-to-date science that more accurately scores carbon intensity for corn ethanol and other renewable fuels.

If federal regulators use a different model to administer these tax credits, it is likely that national goals such as the Biden Administration’s SAF Grand Challenge for decarbonization of the airline fleet will not be met. Additionally, farmers, rural communities, and U.S. biofuel producers will not be able to participate in global SAF markets and miss out on opportunities in other hard to decarbonize sectors.

What Is CORSIA and How Does It Differ from GREET?

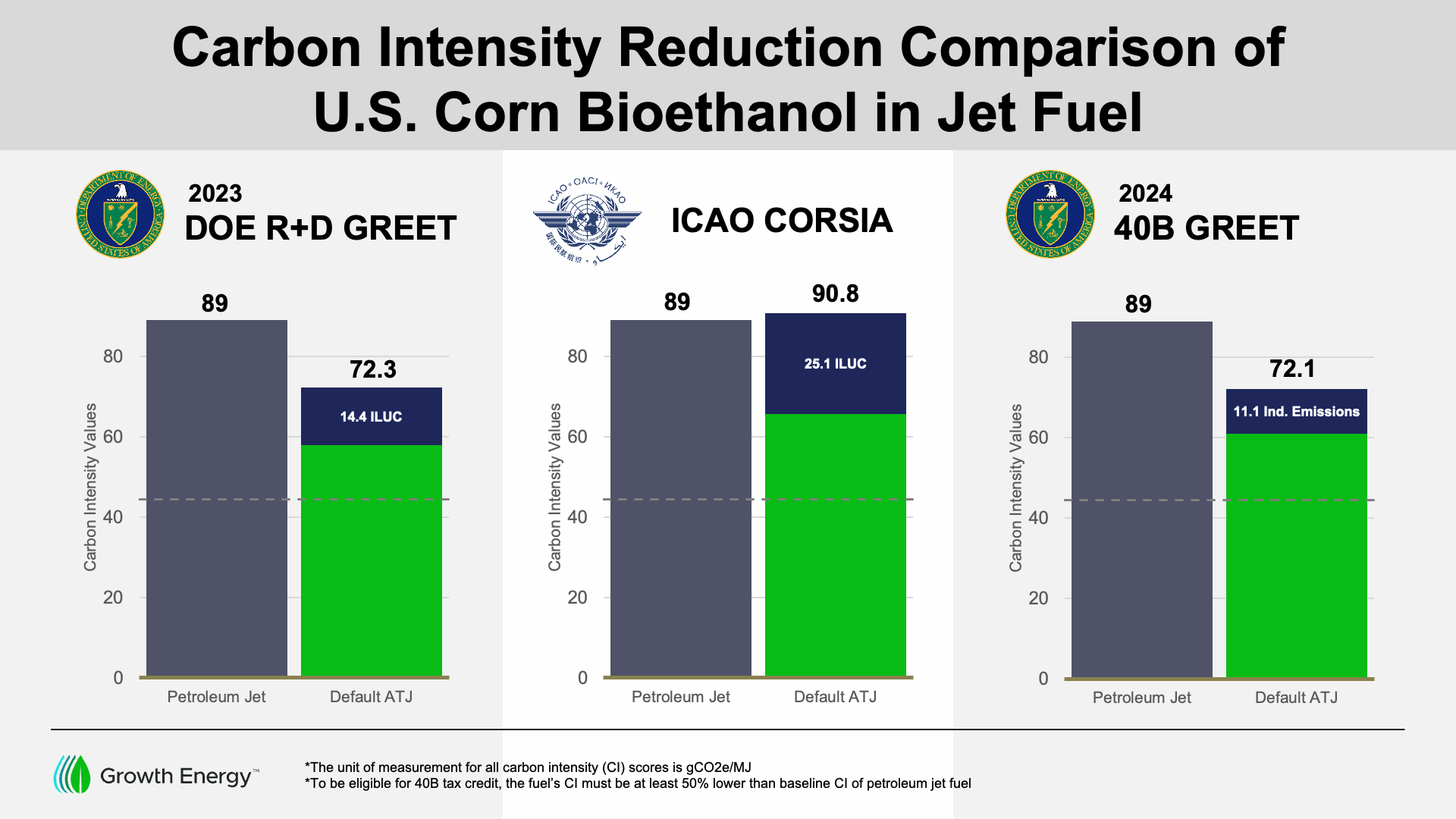

CORSIA stands for Carbon Offsetting and Reduction Scheme for International Aviation. It’s a competing lifecycle analysis model built and maintained by the International Civil Aviation Organization (ICAO) (sometimes the CORSIA model is simply referred to as ICAO, but they refer to the same thing). CORSIA relies on some of the same data used by GREET to arrive at its estimates of carbon intensity, but in some important areas the two models diverge.

The most noteworthy and important of these differences comes down to how each model accounts for land-use change (LUC or sometimes indirect land use change or iLUC). The theory is that the more the production of a certain crop disturbs existing land, the greater its carbon intensity, since soil can capture and store carbon (meaning when the soil is dug up it releases that carbon into the atmosphere). GREET’s estimate of how much the production of bioethanol impacts land use is based on much more recent data than CORSIA’s; farmers that produce the corn that goes on to make bioethanol have found ways over the last several decades to increase their crop yield on fewer acres while decreasing how much their planting processes disturb the soil. GREET accounts for these innovations, while CORSIA uses a land-use change estimate that’s based on data from nearly a decade ago.

The result of this schism between the two models means that CORSIA’s estimate of bioethanol’s carbon intensity is much higher than GREET’s, again, because it inflates how much the process of making bioethanol disturbs the land. If regulators awarding carbon reduction tax incentives were to only rely on CORSIA, they would disqualify most bioethanol produced from corn and thereby lock these farms and producers out of the SAF market.

What Is the 40B GREET model?

In April 2024, the U.S Treasury issued guidance for the IRA’s 40B SAF tax credit which included a bespoke GREET model designed for use with this specific incentive. To its credit, the new 40B GREET model aligned with scientific consensus and assigned a lower iLUC value to bioethanol used in the production of SAF than even the standard GREET model.

The 40B guidance also included requirements that bioethanol producers seeking to claim the credit must use corn farmed using three specific climate smart agricultural practices—cover crops, no-till farming, and enhanced fertilizer. Notably, the guidance stipulates that farms must use all three practices in order for their corn to qualify—not just one or two of them.

Taken as a whole, Treasury’s guidance will make qualifying for the 40B tax credit a tall order, but it still provides a path for bioethanol producers to take advantage of this incentive. Hopefully, in future guidance (like for the IRA’s 45Z Clean Fuel Production credit), Treasury will widen this path even further and make it easier for bioethanol producers to qualify for the credit and use it to ignite growth and investment in American SAF production.

What Impact Would Growth Energy’s Policy Priorities Have on Consumers, the Economy, or the Environment?

- Tax incentives awarded using the GREET model have the potential to spur even more new investments in climate-smart farming practices, carbon capture, utilization, and storage (CCUS), renewable energy, and other proven emissions-reducing technologies.

- Specifically, if the GREET model is used in the application of the Section 45Z clean fuel production tax credit in the Inflation Reduction Act (IRA), this one tax credit alone would add $21.2 billion to the U.S. economy, generate nearly $13.4 billion in household income, support more than 192,000 jobs across all sectors of the national economy, and provide farmers with a 10 percent premium price on low carbon corn used at an ethanol plant.