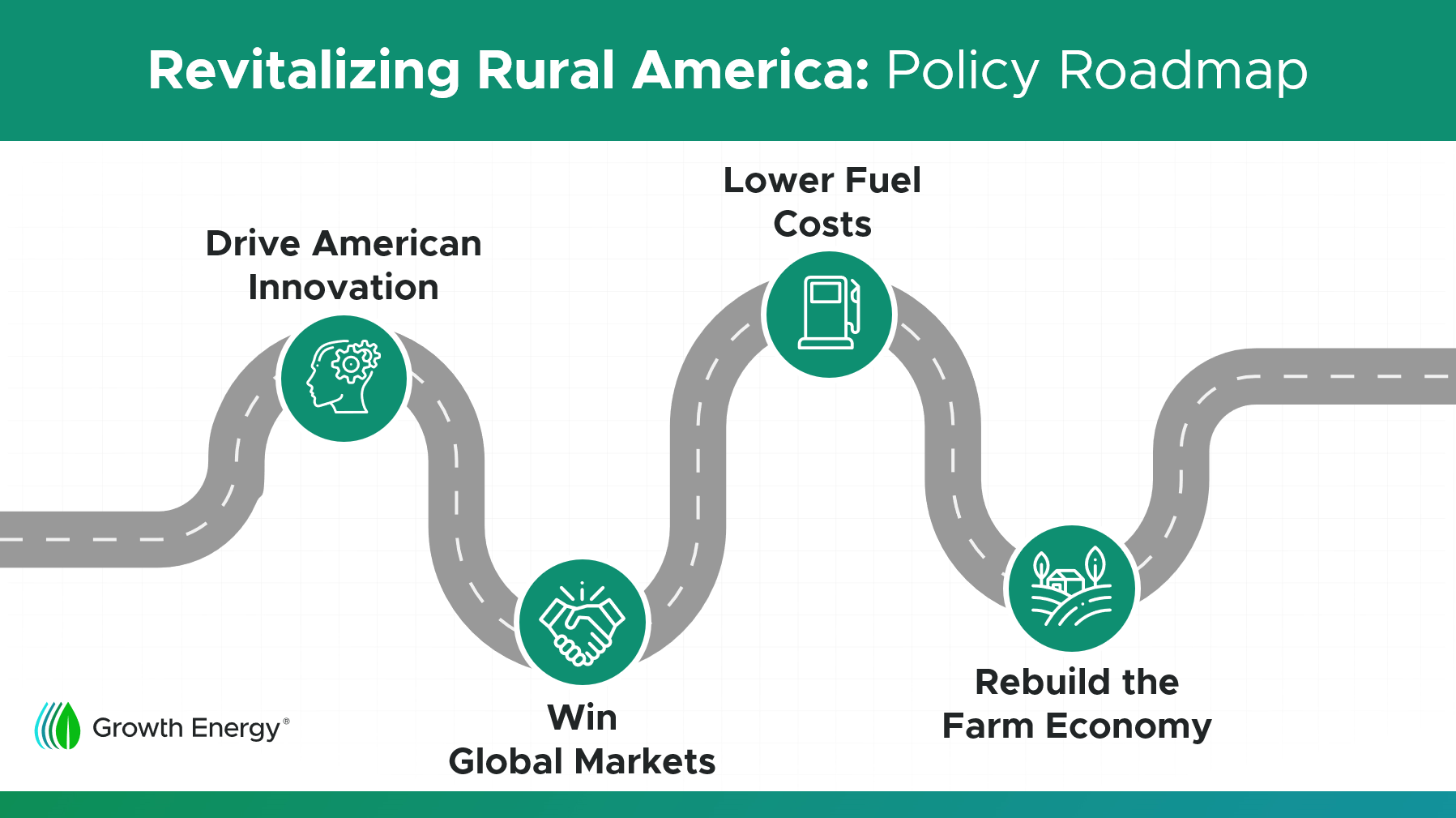

Revitalizing Rural America

America needs American biofuels.

Homegrown American ethanol holds down gas prices, strengthens our domestic energy production, brings jobs and prosperity to rural America, and delivers cleaner air.

Below are specific policy priorities that can lead America into a stronger, cleaner, and more prosperous future.

Only biofuels can unlock the investments and jobs needed to restore the rural economy. We cannot allow regulatory uncertainty to hold back billions of dollars of investment into rural communities.

- RFS: Set timely, ambitious biofuel requirements under the RFS to spur continued growth and investment in rural communities.

- SREs: Continue to limit small refinery exemptions (SREs) and ensure SREs are reallocated to prevent demand destruction.

- CCUS/Permitting: Meet permitting timelines for carbon sequestration projects and support innovative transportation and storage technology.

- New Markets: Promote investment in a fast-growing ecosystem of bioproducts, from Sustainable Aviation Fuels (SAF) to green chemicals to bio-based solutions for marine and freight transport.

E15 reduces gas prices — but only when federal regulations don’t block consumer access. It’s time to lift the needless regulations standing between U.S. consumers and lower-cost E15, so all Americans can make their own fuel and vehicle choices.

- E15: Restore permanent, unrestricted access to E15 for all months, all states, all stations, and all fuel dispensers.

- Retail Expansion: Promote programs designed to fast-track the investments needed to offer better options at the fuel pump.

- Marketing Barriers: Streamline regulations that impose onerous labeling and underground tank requirements on existing infrastructure.

- Vehicle/Fuel Standards: Ensure engine performance and fuel standards harness the full power of American bioethanol to reduce tailpipe and carbon emissions.

Pro-growth tax policy can unlock billions of dollars in new investments in U.S. energy innovation. With proper implementation, new tax credits could be the starting pistol for rural communities waiting to access new economic opportunities and deliver on the promise of climate-smart agriculture.

- Low-Carbon Solutions: The U.S. Treasury Department must provide clear and timely tax guidance that accurately rewards all available decarbonizing strategies on the farm and at the biorefinery.

- Modeling: Ensure fuel standards and tax policy are guided by Argonne National Laboratory’s GREET model, which is the gold standard for measuring the emissions-reducing power of farm-based feedstocks and biofuels.

- SAF/Flexibility: Ensure regulations give farmers the flexibility they need to adopt low-carbon strategies that work best for their farm.

- Clean Fuels Tax Extension: Extend a pro-growth 45Z so biofuel producers and our farm partners have the long-term certainty needed to accelerate innovation in America’s bioeconomy.

America is the world’s largest producer and exporter of biofuels. With fair access to foreign markets, American producers will dominate the global bioeconomy.

- Fair Trade: U.S. trade diplomats must combat unfair trade barriers and tariffs imposed by competitors in Brazil, China, India, Europe, and Southeast Asia.

- Expanding Markets: Open new export opportunities for low-carbon biofuels by supporting higher blends in Canada, Japan, India, Mexico, and across the globe.

- Domestic Feedstocks: Advance fuel policies that do not advantage foreign feedstocks over low-carbon commodities harvested on American farms.