RINs are the primary regulatory tool of enforcement for the RFS and they aren’t all that easy to understand. Here are some key facts about them to make sure you have all the tools you need when defending the RFS and rural America.

What are Renewable Identification Numbers?

Renewable Identification Numbers, also known as RINs, were created in the mid-2000s as a way for the oil industry to reliably comply with the Renewable Fuel Standard (RFS). In other words, they’re proof of compliance for regulated oil companies to show that each refiner is able to meet their blending requirements set forth under the RFS.

How are they generated?

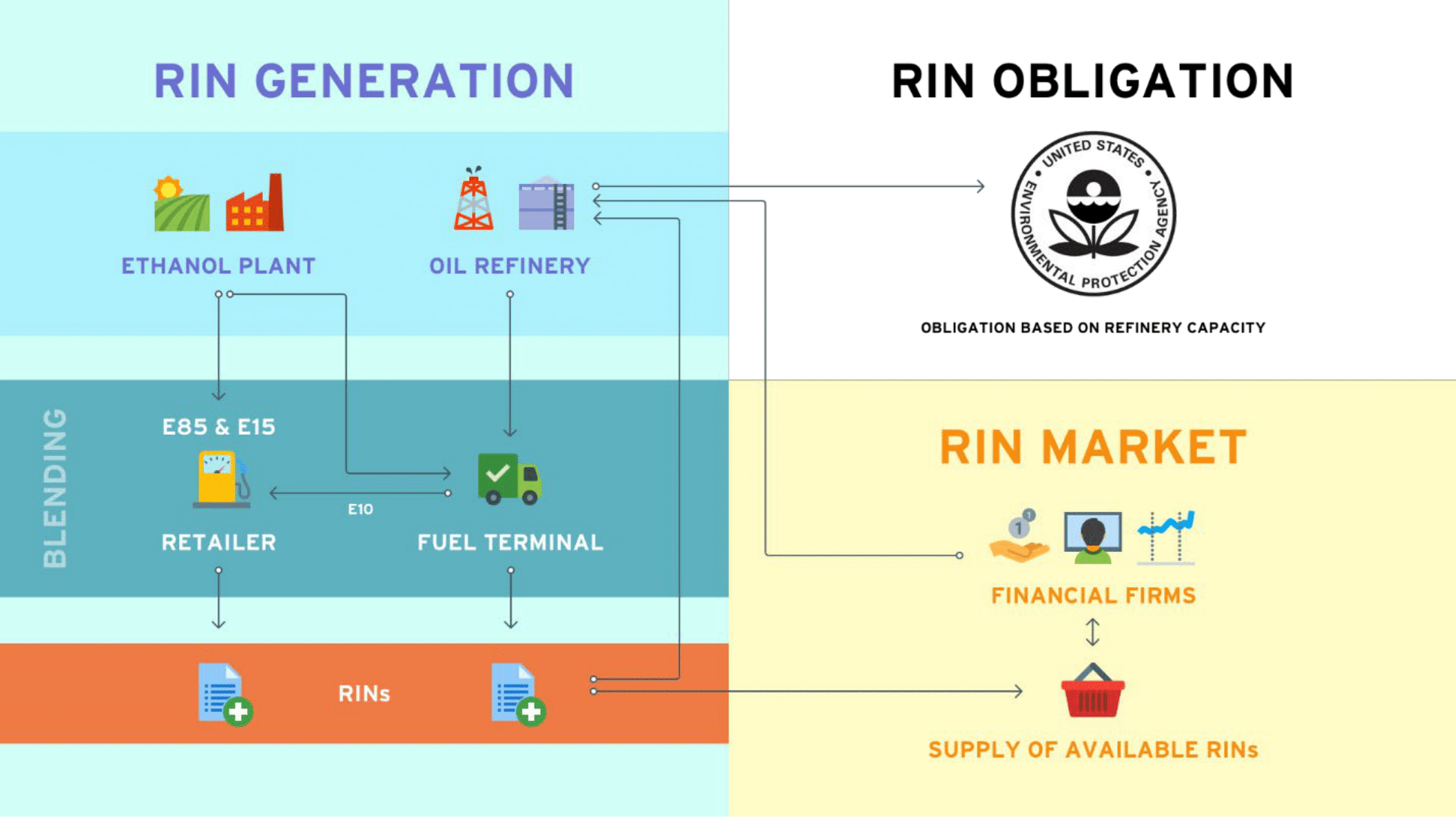

A RIN is essentially a ticket or identification number that is tied to each gallon of biofuel produced. For instance, one gallon of ethanol produces one RIN, or “ticket,” while one gallon of biodiesel produces one and a half RINs “tickets.” Each of these are then attached to the gallon of biofuel that they were produced with until that gallon is blended down the production stream by blenders.

How do oil refiners use RINs?

Each refinery is required to blend a certain number of gallons based on the percentage of the total US refinery capacity made up by their production. This is set by the EPA and is called the Renewable Volume Obligation for each year.

Gallons of ethanol are blended into the US fuel supply and RINs “tickets” attached to those gallons become detached and can be turned in to the Environmental Protection Agency (EPA) to demonstrate that they’ve met their blending requirements. However, some refiners blend more ethanol than they are required to and can keep their excess RINs for up to two years, which they can then sell on the market to other refiners who may be unable to meet their blending requirements. Similarly, other blenders may also blend renewable fuel and capture RINs without having an obligation, and they, too, can sell their RINs on the market to other obligated refiners. In this way, RINs act as a market-based compliance tool that allows refiners to operate in a more flexible manner to meet their obligations.

Why are RINs important?

The market-based RIN system creates flexibility for refiners, while ensuring compliance so that the environmental and price related benefits of the RFS are ultimately felt by consumers.